Government funding for medical cannabis

Legal medical cannabis comes in many forms and delivery methods, and prices vary greatly. The cost of cannabis for a patient will vary based on several factors. And, while the price of medical cannabis products has come down over the past few years, many patients still report that the ongoing cost of being a patient makes legal cannabis a short term solution.

Medical cannabis still costs so much for patients because there is limited financial assistance from the government. As a result, some of the most frequently asked questions are, “Does the PBS cover medical cannabis or CBD oil?” and, “Does private health insurance cover medical marijuana or CBD oil?”

If you’re a veteran, you may want to look into Defence Health Limited Insurers (below) and then check out our DVA funding article.

Patients often call their insurers and are immediately told that their insurance company doesn’t cover medical cannabis. Unfortunately, like many other aspects of cannabis, the customer service teams at Australian health funds lack an understanding of the space.

This article will answer all of the questions you have about medical cannabis coverage related to Medicare, the PBS, and Private Health Insurance. We spoke with at least one customer service representative from each of the private health insurers in Australia to get you a definitive answer as to whether your insurer covers medical cannabis. Here’s what we’ll cover in this article:

- Does Medicare cover medical cannabis appointments?

- Does the PBS cover my medical cannabis or CBD oil?

- Does private insurance pay for medical cannabis or CBD oil?

- How to talk to your insurer about medical cannabis.

- A list of private insurers that cover medical cannabis (and the required level of cover)

- Third party insurance provider experiences

Does Medicare cover medical cannabis appointments?

There is no simple yes or no answer to this question. When accessing medical cannabis, you have multiple options. People tend to either see a GP or go to a medical cannabis clinic. As you might already know, medicare often provides a rebate to help to cover GP visits.

So, if your GP is your medical cannabis prescriber, and your GP only charges you for your appointments, then the answer will likely be; Yes, medicare will cover your medical cannabis doctor appointments. If you’re looking for a local GP or specialist who can prescribe and may bulk bill, you can look through our list of prescribers.

If you go to a cannabis clinic, you’ll have to do your research. Most clinics offer Telehealth, while very few clinics offer in-person appointments. If you visit a clinic local to you and see your doctor in person, there is a chance that Medicare will also cover a portion of your appointments. However, you must ask the clinic prior to your appointment if Medicare will cover any portion of costs. You can learn which clinics do and don’t offer in-person appointments in our cannabis clinics article.

Once you know if your appointment costs will be covered, then you may want to know if the PBS will cover your medication.

Does the PBS cover medical cannabis or CBD oil?

Unfortunately, the answer is no. Medical cannabis is an unapproved medication in Australia. This means that it is not listed on the Australian Register of Therapeutic Goods (ARTG) because it lacks enough clinical research to meet the eligibility requirements for listing.

While the PBS only covers ARTG listed medications, the PBS does not cover the two medical cannabis products (Sativex and Epidiolex) currently listed on the ARTG.

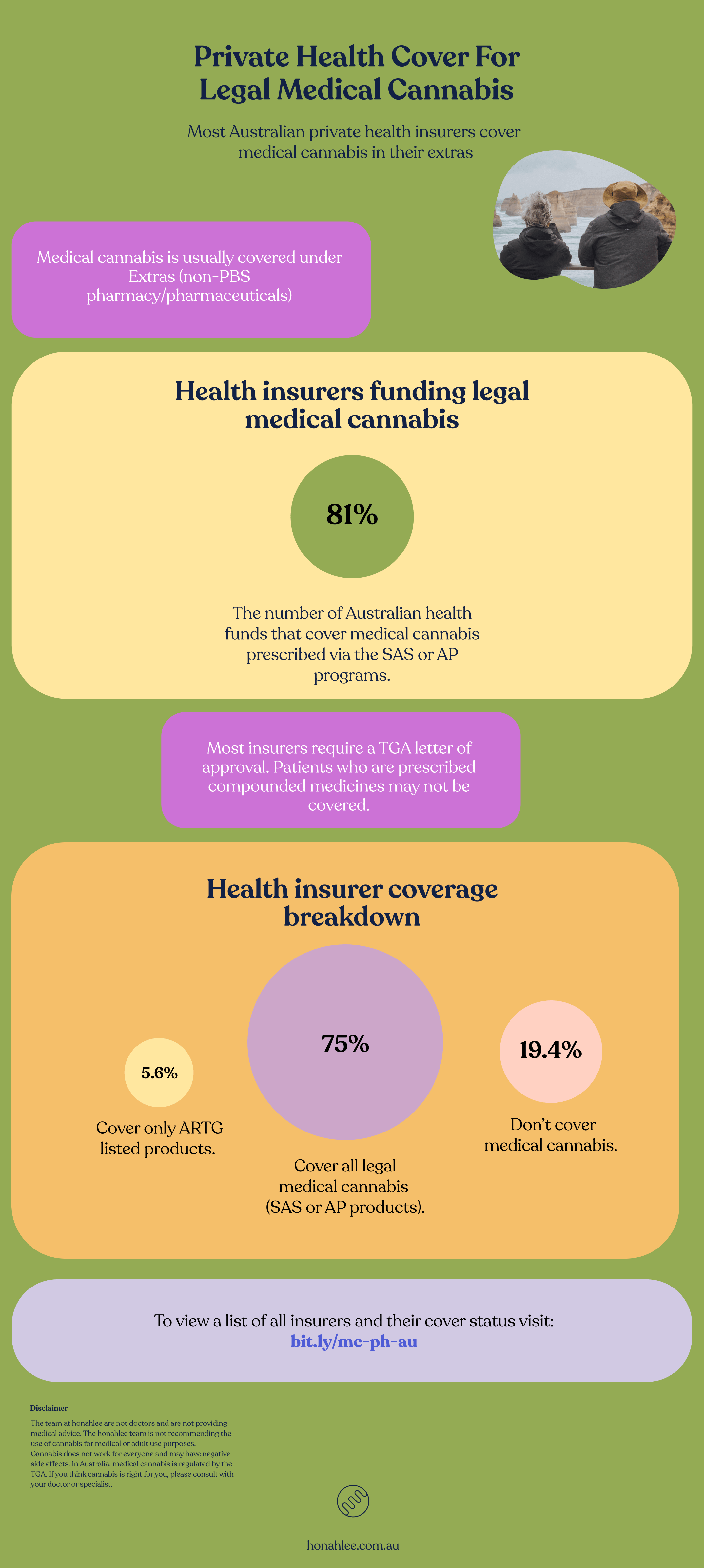

Does health insurance cover medical cannabis or CBD oil?

Most likely, yes. We spoke with all of the private health insurers in Australia and about 70% of Australia health funds cover medical cannabis in some form.

A few of the funds only cover ARTG listed medical cannabis products (Sativex and Epidiolex) and most of them will cover any medical cannabis product as long as you are able to provide a few pieces of evidence. In order to be covered you may have to provide

- Proof of your TGA approval

- A letter from your doctor (usually a template can be provided by the insurer)

- A pharmacy receipt that proves the PBS didn’t cover your medication (request this from your pharmacy as it’s a specific receipt separate from a tax invoice)

What’s important to note is that most insurers said that the product had to be prescribed via the SAS or AP pathways, which means that patients prescribed compounded products would not get reimbursement for their medications.

How insurance cover works

When you have an Extras plan covering medical cannabis, you’ll usually pay part of the script fee, and the insurer will cover some or all of the balance. All of the insurers that cover cannabis said that you have to pay the PBS co-payment, which in 2020 is $41 and then the insurer will begin to cover your medication.

After the co-payment, insurers will either cover part or all of the balance of the script fee. Most will only cover a specific percentage or dollar amount per script.

Before providing a list of Australian health insurance providers covering medical cannabis, we’ll explain how to talk to your insurer about your cannabinoid medication.

How to talk with your insurer about medical cannabis

The reason we’re giving you this advice is that it’s always best to get something in writing directly from your insurer / a new insurer so that you know exactly what you’re getting with your coverage. While we did speak with representatives from each of the insurance companies, it wasn’t easy to get straight answers. In some cases, we talked to a handful of people before getting a yes or no, so it’s essential you re-confirm this information with your provider.

If you call your provider and they tell you that they don’t cover medical cannabis, don’t worry. Many of the customer service reps are uneducated about legal medical cannabis. When we called up the insurers, there were numerous instances where the immediate answer was no. Then, a couple of minutes later, we were being thanked by the customer service rep because we had taught them something.

Here’s what you need to know about talking to your provider:

- Medical cannabis is covered under most private health funds’ non-PBS pharmacy, pharmacy, or non-PBS pharmaceuticals category.

- Even though medical cannabis isn’t on the ARTG, for you to get a script, the TGA approves your prescription either via the SAS program or the AP program. If you are getting a compounded product, you do not have TGA approval.

- If you’re having trouble with the initial customer service rep, you can tell them to ask their claims team if they cover S4 or S8 medical cannabis products that the TGA approves via the SAS or AP programs. Many reps will ask you for your product name. Unfortunately, giving them the name most times won’t progress the conversation. You need to talk to a manager or ask them to confirm with their claims department to get the answer.

- You may want to ask them to check if they cover Cannabidiol or CBD products.

- If you’re getting conflicting information from our article and your fund, it’s best to ask them who you can email to get a definitive answer and follow up that way.

Again, it’s best to make sure you have all the details of your insurance policy with relation to medical cannabis in writing before upgrading or changing policies.

A list of private health insurers that cover legal medical cannabis

Each health fund in Australia has a range of plans. Medical cannabis is usually covered under the non-PBS pharmacy, pharmacy, or non-PBS pharmaceuticals category. The table below gives you a very high-level overview of each fund and its plans covering legal medical cannabis.

We’ve listed the names of the lowest-cost plans covering cannabis and the annual limit for each of those plans. You’ll also see the maximum payout per script if the company was willing to provide it.

Again, you’ll most likely need to provide the following information to your insurer:

- Proof of your TGA approval

- A letter from your doctor (usually a template can be provided by the insurer)

- A pharmacy receipt that proves the PBS didn’t cover your medication (request this from your pharmacy as it’s a specific receipt separate from a tax invoice)

Three final reminders as you read this chart:

- Non-PBS pharmacy annual limits may be shared with other extras benefits in your policy.

- The plans listed are the lowest cost plans and therefore the lowest benefits.

- The extras and benefits listed are per-person, not a family rate.

Here’s the list

| Insurer Name | Covers Legal MC | Lowest Rate Extras | Annual Limit | Max Cover Per Script | Plan Type** |

|---|---|---|---|---|---|

| ACA Health Benefits Fund | Y | Ancillary Lite | $250 | $50 | E |

| AHM health insurance | Y | Lifestyles Extras | $350 | $50 | E |

| AIA Health Insurance | Y | Enhanced Extras | TBD | TBD | H + E |

| Australian Unity | ARTG Only | Basic Extras | $100 | 100% | E |

| Bupa | N | NA | NA | NA | NA |

| CBHS Health Fund | Y | Essential Extras | $200 | $50 | E |

| CDH Benefits Fund | N | NA | NA | NA | NA |

| CUA Health | Y | Essential Extras | $100 | $25 | H + E |

| Defence Health | Y | Value Extras | $500 | $100 | E |

| Doctors' Health Fund | ARTG Only | Only have one plan | NA | NA | NA |

| GMHBA | ARTG Only | Basic Extras | $150 | $21 | E |

| GU Health | ARTG Only | Budget 50 benefits | $200 | 100% | H + E |

| HBF Insurance | ARTG Only | NA | NA | NA | NA |

| HCF | N | NA | NA | NA | NA |

| Health Care Insurance | N | NA | NA | NA | NA |

| Health Insurance Fund of Australia | Y | Saver Options | $350 | $80 | E |

| Health Partners | Y | SA: Basic Extras All other: Freedom Extras | $100 $200 | $20 $40 | E |

| health.com.au | Y | Extras 50 | $350 | $50 | E |

| Latrobe Health Services | Y | Basic Extras | $250 | $22 | E |

| Medibank^ | Y | Healthy Start Extras | $500 | $21 | E |

| Mildura Health Fund | Y | Five Star Extras | $300 | $35 | E |

| Onemedifund | Y | Comprehensive Extras | $500 | $65 | H + E |

| Navy Health | Y | Budget Extras | $200 | $50 | E |

| NIB Health Insurance | ARTG Only | Young At Heart Extras | $400 | 60% | E |

| Nurses & Midwives Health | N | NA | NA | NA | NA |

| Peoplecare Health Insurance | ARTG Only | Simple Extras | $200 | $50 | E |

| Phoenix Health Fund | Y | Kick Start Extras 50 | 200 | 50% | |

| Police Health | Y | Only one Extras plan | $600 | 100% | E |

| Queensland Country Health Fund | Y | Young Extras | $150 | $45 | E |

| *Railway & Transport Health Fund | Y | Value Extras* | $300 | $35 | E |

| Reserve Bank Health Society | Y | Only one Extras plan | $1,000 | $100 | E |

| St.Lukes Health | Y | Super Extras | $600 | $70 | E |

| Teachers Health | ARTG Only | TBD | TBD | TBD | TBD |

| * Transport Health | Y | Healthy Choices Extras | $400 | $50 | E |

| TUH Health Fund | Y | Basic Extras | $250 | $50 | |

| Westfund | N | NA | NA | NA | NA |

** E = extras only plans available | H + E = can only get extras with hospital plan

^ Patient reported that the fund also covers repeats

For those of you prescribed Little Green Pharma (LGP) medicine, it’s may be worth looking into HIF. HIF and LGP worked out a deal whereby patients taking LGP medication get an increased rebate on each claim (normally $80 per script, now $105 per script until June 2022). You can learn more about this offer on the site.

3rd party insurance provider experiences

While the honahlee team spent lots of time speaking with insurers, we’ve also been lucky enough to receive patient and cannabis industry feedback on this information. Thanks to the patients who took the time to follow up with us. We’d also like to thank the team at Cronos Australia for providing further confirmation with a shortlist of their confirmed insurers.

Patient or 3rd party confirmed:

- AHM health insurance

- CBHS Health Fund

- CUA Health

- Defence Health

- GMHBA – ARTG only

- Health Insurance Fund of Australia

- Health Partners

- Medibank (also cover vapes – see below)

- Queensland Country Health

- St.Lukes Health

- Teacher’s Union (TUH) Health

If you’re a patient with one of the providers on our list and have some real-world experience that you’d like to share, please send an email to [email protected].

Bupa

When the honahlee team called Bupa, they informed us that they covered medical cannabis. We’ve had patient confirmation that Bupa covered one script. However, in February 2021, Bupa said they would no longer cover their medication. Based on this feedback and other patients saying Bupa does not cover cannabis, we’ve updated the Bupa listing.

HIF

This note is to provide comfort for any patients having difficulties with HIF.

We’ve confirmed that two patients have had their medical cannabis claims rejected while still within their annual limits. This happened after the patients provided the required information to HIF multiple times. It’s important to note that while you may get the runaround – be persistent. Both patients have since had their cannabis scripts covered, but not without spending hours going back and forth with the company.

Medibank

Medibank has some pros and cons which a patient explained for us. Unfortunately, they will only cover the first dispensing of a script with repeats. The patient was told this is an internal policy. What’s great about Medibank’s insurance is that they will cover partial costs for an approved TGA vaporiser. The patient was able to provide a letter from their doctor and the TGA approval for flower and Medibank covered 30% of the cost of the Mighty Medic vape.

Teacher’s health

We’ve had mixed information on Teacher’s Health. One patient said that they’ve been claiming their medication up to $700 per year. We recently had another patient write in and show us a response from Teacher’s Health which said they only cover ARTG listed medicinal cannabis and therefore they will only cover Sativex and Eipdyolex.